Markets are complicated systems driven by almost innumerable variables, but generally speaking, three broad areas are driving markets today. As we look forward to the remaining 2/3 of 2024, it is worth looking at each of these categories and how they are impacting markets.

Economics

As we survey economic data over the past several months, the overall feeling is somewhat lukewarm. There aren’t smoking guns suggesting economic decline is imminent, nor is there a lot to suggest we’re on the cusp of significant expansion. For example:

- Inflation has come down significantly, but is still well above the target of 2%

- Corporate earnings are solid, but not overwhelming

- Stocks are neither particularly cheap based on price/earnings ratios nor are they overly expensive

- Unemployment is low, but the data excludes the mass exodus of workers from the workforce over the past several years

- Interest rates are significantly elevated relative to the last few years, but are not overly high based on the historical record

- Market indicators have been suggesting an imminent recession for some time, but it hasn’t materialized

- GDP growth has been solid, but is forecast be more muted in the coming years

Elections

2024 is a historic year for elections worldwide. Over 49% of the world’s population will be holding national elections this year.

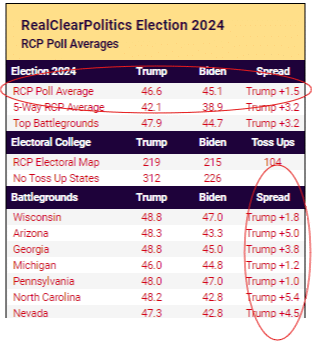

Here in the US, we face a very contentious, very close election. Polls currently show the following:

Source: RealClear Politics

While the race is extremely close in absolute terms (within the margin of error). The polling numbers in battleground states show a different picture as former President Trump has a material lead in several key states. We are, however, six months away from the election which is an eternity in a modern Presidential Election year.

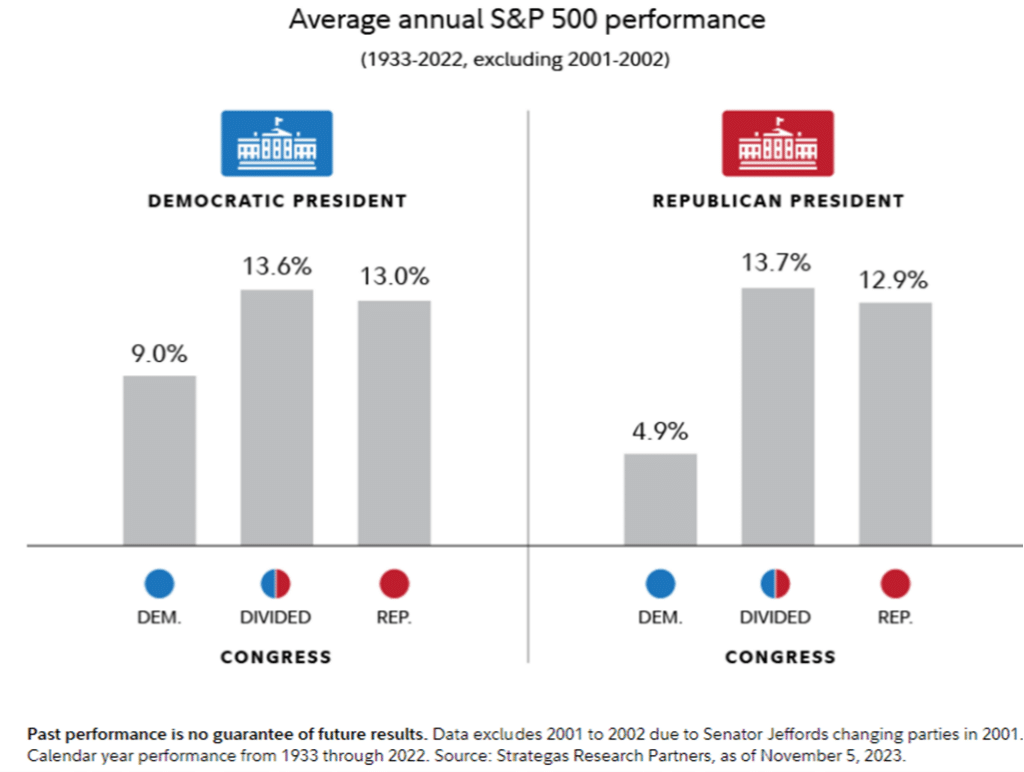

As important as elections are for policy, the degree to which election outcomes impact markets over time is often overstated. Below is the average annual market performance based on different combinations:

Here we observe that situations where we have a divided Congress and either party in the White House result in nearly identical market gains. Scenarios where we have a Republican Congress and either party in the White House also resulted in nearly identical gains. Full Democratic control of both Congress and the White House led to lower returns, but the worst combination for market performance was a Republican President and full Democratic control of Congress.

The likelihood of either of the two lagging scenarios (full Democratic control of Congress and either a Democrat or Republican in the White House) is relatively low this election cycle. The Senate race is leaning Republican, but will likely be tight. Similarly, the race for the House of Representatives is also tight and is probably a toss-up. To the extent one party has a clean sweep (control of both Houses of Congress and the Presidency), majorities will likely be razor thin.

Geopolitics

Geopolitical risk is the risk of a major event on the world stage (i.e. wars, blockades, embargoes, etc.) impacting markets adversely. There is no question that geopolitical risk is more heightened today than it has been in decades. As one surveys the globe, the number, the intensity, and the potential impact of current conflict is worrisome:

Source: Council on Foreign Relations

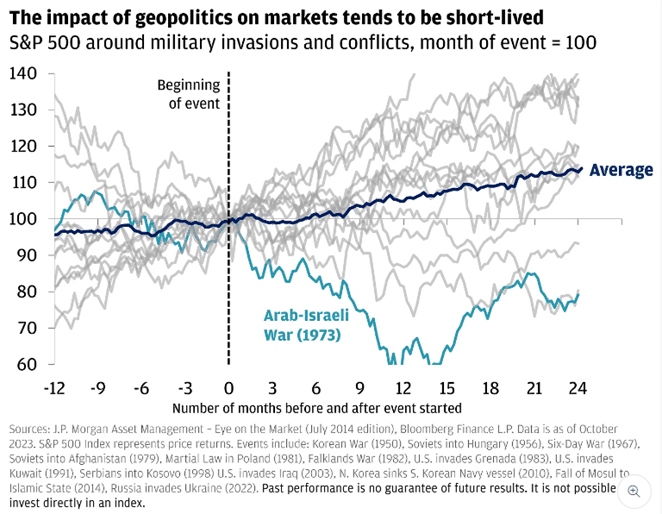

As with elections, the impact of geopolitical shocks on markets is often overstated. The below chart shows that on average, there is often a drop leading up to the event (as markets anticipate the coming conflict), but on average, markets bounce back fairly quickly. This chart is interesting because it shows that on average, not only is the drop very modest, but it is also very short lived:

The caveat here is that there are outlier situations that could lead to more severe impacts. For example, the most impactful of current/potential conflicts from an economic standpoint is a Chinese invasion of Taiwan. Bloomberg estimates a $10 trillion impact of such a conflict. This is 10% of global GDP and would obviously have huge impacts on global trade and supply chains. While we feel like such a conflict is unlikely in the near term, it is more possible today than it has ever been.

Other potential conflicts would have varying impacts to the degree that they upset energy markets, supply chains, etc. For example, a full-scale regional war between Israel and Iran could roil global energy markets.

We are aware of and follow geopolitical developments closely and loosely characterize them as follows:

| Low Probability | High Probability | |

| Low Impact | 1 | 2 |

| High Impact | 3 | 4 |

We don’t have any high probability/high impact (quadrant 4) scenarios we’re tracking now, but would place the situation in both the Middle East and the Taiwan Strait in the low probability/high impact category (quadrant 3). Situations in quadrants 1 and 2 likely have minimal market impact. The key takeaway here is that quandrant 3 and 4 items happen very infrequently.

One can overprepare for quadrant 3 items and leave a lot of return over time on the table. One can also underprepare and have too much portfolio concentration and consequently be unable to weather significant geopolitical shocks.

Gameplan and Conclusion

In terms of how to plan for the upcoming months, perhaps consider the following:

- While markets were down in April, the November 2023-March 2024 stretch was outstanding. This is a great time to re-evaluate one’s portfolio. It is far easier to objectively review one’s portfolio and risk tolerance during a time like now compared to times of market duress. Consider for example, how you felt during the 2022 market drawdown. Were you losing sleep or were you confident in your portfolio? If you were losing sleep, now might be a good time to review and reallocate.

- Be aware of “hot dots”. In investing, hot dots are positions that have significant momentum that crowds tend to pile into. It is difficult to be successful with a strategy of only buying those items that have already had a significant run up. A good portfolio inevitably has some temporarily out of favor items. For example, many today are heavily concentrated in US technology shares with little exposure to other assets. While US technology companies are tremendous and have a definite place in most portfolios, they have already had a significant multiyear expansion. Those who overconcentrate in these to the neglect of things like bonds, international stocks, and value stocks may find they are unwittingly carrying more risk than they thought in the next downturn

- Beware of neglecting entire asset classes. We have had anomalous markets since the onset of the pandemic (fastest drop in market history, worst market for bonds in history, breathtaking growth in tech names, etc.). Because of this, some neglect long-standing market fundamentals that still hold. For example, the most widely recognized bond index has the following returns:

- 1-year annualized return of -.64%

- 3-year annualized return of -3.27%

- 5-year annualized return of .02%

One might look at this data and infer that investing in bonds is a fool’s errand and omit this from their portfolio. In doing so, they would likely be missing the following:

- Bonds prices move inversely with interest rates. Rates are forecast to eventually decline and barring significant defaults, bond prices would go up

- Yields have been pushed higher with rate increases and the 30-day SEC yield on the index is 4.81%. This means that one would collect this interest and benefit from any price appreciation due to rising rates

- In times of recession, rates will typically be lowered and this increases a bond’s value. Bonds also remain “flight to safety” instruments during times of turmoil

Markets are fundamentally the same as they have been for decades and human nature hasn’t changed for millennia. As such, most long-standing investing fundamentals are still relevant

In summary, as we survey markets today we have a complex stew of different economic, electoral, and geopolitical factors that bring heightened uncertainty but aren’t necessarily cause for deep pessimism in the aggregate. As stated above, this is a great time to review one’s portfolio and we look forward to doing so with many of you in the coming months.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Diversification, asset allocation and rebalancing strategies do not ensure a profit and do not protect against losses in declining markets. Rebalancing may cause investors to incur transaction costs and, when rebalancing a non-retirement account, taxable events may be created that may affect your tax liability.

Investing involves risk, including loss of principal. Supporting documentation for any claims or statistical information is available upon request.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve. Past performance is no guarantee of future results and the opinions presented cannot be viewed as an indicator of future performance.

Alliance Wealth Advisors, LLC, is registered as an investment advisor with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the advisor has attained a particular level of skill or ability a SEC Registered Investment Advisor – 1148 West Legacy Crossing Blvd., Suite 110, Centerville, UT 84014.